Personal loan business (P-Loan) becomes a massive growing business as it has served the needs of people group who cannot access financial services of the large service providers, especially banks. The Bank of Thailand unlocks regulations that block the service access of these unserved and underserved groups by addressing the digital Alternative Data for the financial loans approval and payment capability evaluation.

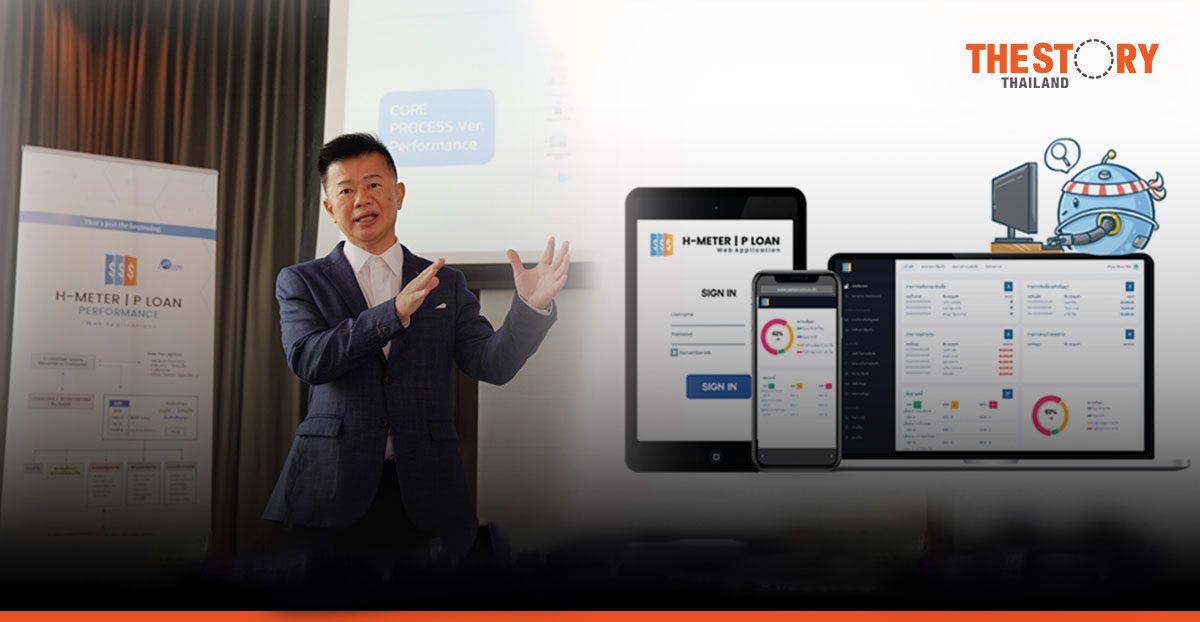

Somkiat Ungaree, CEO, and founder of Senior Com Co, said the Bank of Thailand’s new rule for digital personal loans has increased new opportunities for entrepreneurs to access the personal loan business (P-Loan), having new personal loan players in the markets. It is also a good opportunity for Senior Com to develop the

“H-METER’ P-Loan, for the digital personal loan business. It is an Instant Personal Loan Online Platform that comes with security and under-regulated by the Bank of Thailand.

Senior Com Co is a software leader providing software services to automotive management software and financial management.

“We are enthusiastic in technology and innovation development. The challenge is an opportunity that we can learn from the real experience. All single Senior Com products are applicable and well recognized in the market,” Mr Somkiat said.

H-METER’ P-Loan has 2 types: Identity group and Performance group. H-METER’ P-Loan for Identity serves for less complex and number users, a medium business upcountry, and implementation time of about 6 months with total cost and service at around 2-5 million baht. H-METER’ P- Loan for performance users is suitable for a large business with 9-month deployment and overall cost including service at a range of 7-20 million baht.

‘H-METER’ P-Loan has features of alternative data such as products and services payment record or a variety of data in approval personal loan instead of income document, such as collateral, checking the borrower history from credit bureau and use of digital technology for service and approval, from loan submission, e-KYC., customer risk assessment, and withdraw the money and pay off debt through a deposit account or electronic money account.

H-METER’ P-Loan will assist personal loan operators to assist users in particular freelance, unproven income, and those who don’t have assets as collateral to access loans in the systems. At the same time, business operators can use digital technology and alternative data in providing their services, at a cost saving but with better efficiency. This also helps build data in the financial system for customers which is useful for other financial services in the future.

‘H-METER’ P-Loan which has been developed over a year can be done on the cloud platform or the on-premise server. The system is outstanding with its simple to use, full features and short time of deployment.

Key features of ‘H-METER’ P-Loan are: pre-credit scoring and credit scoring, eKYC, risk categorization, and compliance with Personal Data Protection Act B.E. 2562 (PDPA) covering the link of API to other agencies and dashboard systems for Field Credit Control (FCC) , loan customer notification via LINE Connect and SMS, as well as a calculation of fine and payment method based on the Bank of Thailand (BOT).

The robust features and best practice of H-METER’ P-Loan enable the loan approval process faster, secured and aligned with the system, the financial loan approval therefore can be done faster and more efficient.

With features and best practice enables H-METER’ P-Loan can speedy approval process, secure and accurate in line with the system and make approval more loans and faster enable efficiency for approval loan of operators better.

Target customers of ‘H-METER’ P-Loan are investors or new fintech entrepreneurs and existing leasing businesses that need to expand to digital personal loans.

‘H-METER’ P-Loan currently has customers such as subsidiaries of a major bank, SET-listed leasing firms, and large automotive leasing companies.

“Personal Loan is a new business that there is not any software package offered as a platform for personal loan consideration and approval in the market, H-METER’ P-Loan becomes the first customizable features developed by a Thai software company.

Somkiat said ‘H-METER’ P-Loan will help sustain the P –loan business growth, existing business operators can simply diversify into personal loans through the use of digital technology and have new players in the market. The platform also helps efficiently reduce bad debt and allows more people to access loans and other financial services in the future.

Reference : https://www.thestorythailand.com/en/04/10/2022/78681/